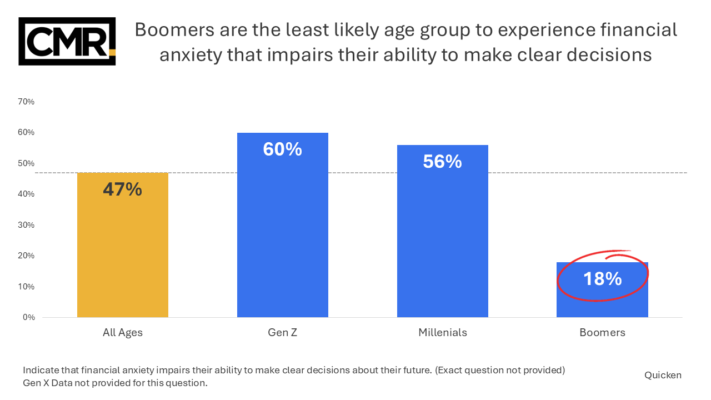

Nearly half (47%) of all respondents report that financial anxiety impairs their ability to make clear decisions about the future

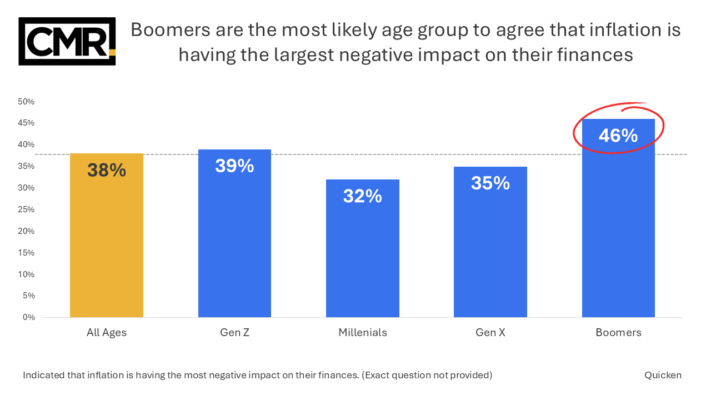

Boomers are feeling inflation more than other age groups

Boomers are feeling the sting of inflation more than any other age group, with just under half (46%) naming it as the most damaging factor to their finances. That’s a sharp contrast to Gen X (35%), millennials (32%), and Gen Z (39%), who are also impacted but to a lesser degree. This difference may reflect the fixed incomes or limited earning windows many Boomers face in retirement, leaving them more exposed to rising costs without the flexibility of increasing wages or career changes.

Boomers also have the lowest financial anxiety of all age groups

When it comes to financial anxiety clouding decision-making, Boomers appear to be experiencing less stress than other age groups. Although nearly half (47%) of all respondents report that financial anxiety impairs their ability to make clear decisions about their future, this anxiety only impacts one-in-five (18%) Boomers, far below the three-fifths (60%) of Gen Z and (56%) of millennials who say the same. While Boomers may have more life experience or financial stability to lean on, younger adults are navigating an uncertain economy while still building careers and families, making their decision-making process feel more daunting and emotionally charged.

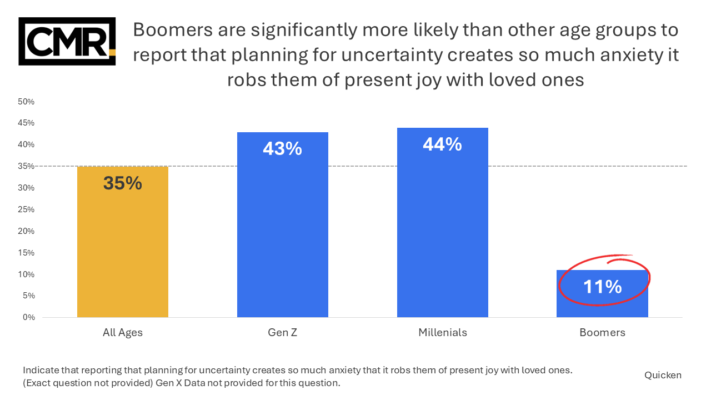

Boomers are the least likely to let financial anxiety rob them of joy

Boomers also report significantly less emotional fallout from economic stress in their personal lives. More than one-third of Americans (35%) report that planning for uncertainty creates so much anxiety that it robs them of present joy with loved ones. However, just one-in-ten (11%) Boomers are robbed of joy with loved ones due to planning for uncertainty, compared to about two-in-five (44%) millennials and members of Gen Z (43%). This wide gap suggests that Boomers, perhaps through a combination of accumulated wealth, life stage, and experience, are better able to compartmentalize financial worry, whereas younger generations are carrying that stress directly into their day-to-day relationships and sense of well-being.

Read more:

Boomers Feel More Financially Blindsided by Inflation Than Younger Americans, Quicken Survey Reveals

Research publisher:

Quicken – Quicken is finance software for people living in the U.S. Quicken offers a suite of personal finance and life management software and apps, including Quicken Simplifi (recognized as the Editors’ Choice by PCMag), Quicken Business & Personal, Quicken Classic Premier, Quicken Classic Deluxe, Quicken Classic Business & Personal, and Quicken LifeHub.

Methodology

Quicken conducted this research using an online survey distributed by PureSpectrum among n=1,000 adults (age 18+) in the United States. The sample was equally split between gender, with a spread of age groups, household income, and geographies represented. Data was collected from February 24, 2025, to March 10, 2025.